What is COBRA health Insurance?

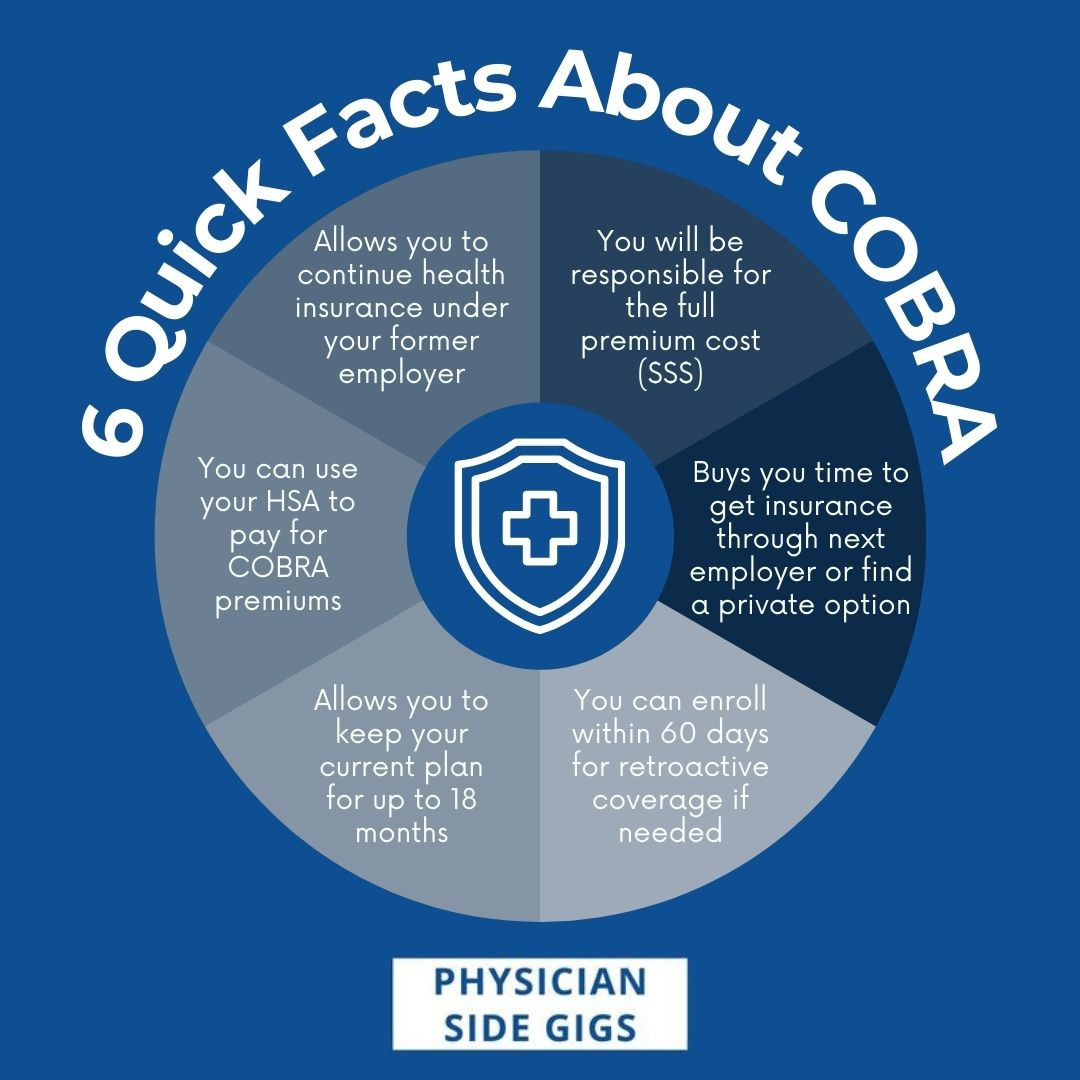

COBRA stands for the Consolidated Omnibus Budget Reconciliation Act, which was enacted in 1985. COBRA health insurance allows employees to continue their health insurance coverage after leaving their job, as long as they meet certain criteria. This means that if you lose your job or experience a reduction in hours, you may still be able to keep your health insurance coverage through COBRA.

Who is eligible for COBRA?

To be eligible for COBRA health insurance, you must have been covered by your employer’s health insurance plan and the employer must have 20 or more employees. You must also have experienced a qualifying event that would result in the loss of your health insurance coverage, such as leaving your job or having your hours reduced. Additionally, you must not be eligible for Medicare or have other health insurance coverage.

How does COBRA work?

When you experience a qualifying event that would result in the loss of your health insurance coverage, your employer is required to notify you of your COBRA rights. You will then have the option to continue your health insurance coverage through COBRA by paying the full premium yourself, including the portion that was previously paid by your employer.

How long does COBRA coverage last?

COBRA coverage typically lasts for 18 months, but it can be extended to 36 months in certain circumstances. For example, if you become disabled or if you experience another qualifying event, such as a divorce or the death of the covered employee, you may be eligible for an extension of your COBRA coverage.

Is COBRA a good option for me?

COBRA health insurance can be a good option for individuals who need temporary health insurance coverage after leaving their job or experiencing a reduction in hours. However, it can be expensive since you will be responsible for paying the full premium yourself. It’s important to compare COBRA coverage to other health insurance options, such as marketplace plans or Medicaid, to determine the best choice for your situation.

Conclusion

:max_bytes(150000):strip_icc()/Intro-cobra-health-insurance_final-80419e34cbe248bda730c7bb6904870f.png)

In conclusion, COBRA health insurance can provide temporary coverage for individuals who have lost their job or had their hours reduced. It’s important to understand the eligibility requirements, how COBRA works, and the cost of coverage before deciding if it’s the right option for you. Be sure to compare COBRA coverage to other health insurance options to find the best fit for your needs.