Health Insurance in Florida

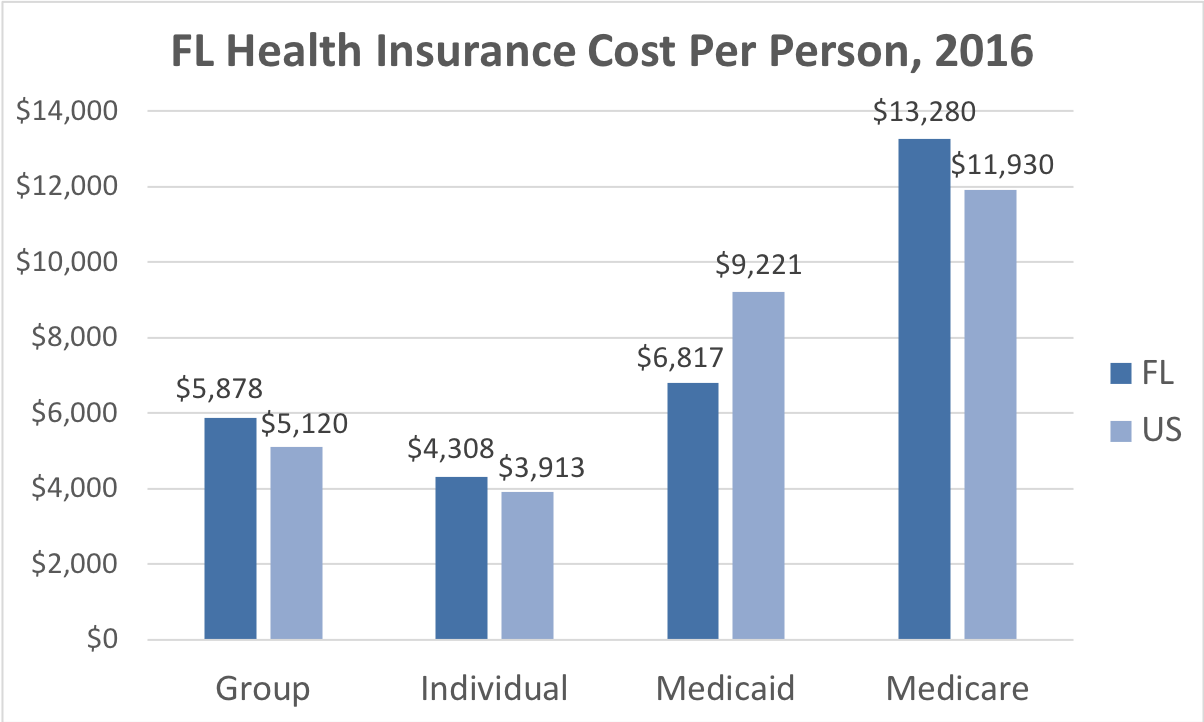

Health insurance is a vital component of financial planning, especially in a state like Florida where healthcare costs are typically higher than the national average. With the rising costs of medical treatments and procedures, having health insurance coverage can provide financial protection and peace of mind for individuals and families.

Types of Health Insurance Plans in Florida

There are several types of health insurance plans available in Florida, including:

1. Health Maintenance Organization (HMO)

An HMO plan requires members to choose a primary care physician who will coordinate all of their healthcare needs. In-network services are typically covered at a lower cost, while out-of-network services may not be covered at all.

2. Preferred Provider Organization (PPO)

A PPO plan allows members to see any healthcare provider, but services provided by in-network providers are covered at a higher percentage. Members do not need a referral to see a specialist.

3. Exclusive Provider Organization (EPO)

An EPO plan offers coverage only for services provided by healthcare providers within the plan’s network. Members are not covered for out-of-network services, except in cases of emergency.

4. Point of Service (POS)

A POS plan combines features of both HMO and PPO plans. Members are required to choose a primary care physician and can receive care from out-of-network providers, but at a higher cost.

Health Insurance Requirements in Florida

In Florida, individuals are not required to have health insurance coverage, but having a policy can protect them from high medical costs in the event of an illness or injury. The Affordable Care Act (ACA) provides subsidies and tax credits to help make health insurance more affordable for individuals and families who qualify.

Benefits of Health Insurance in Florida

There are several benefits of having health insurance in Florida, including:

1. Financial Protection

Health insurance coverage can protect individuals and families from high medical costs, including hospital stays, surgeries, and prescription medications.

2. Access to Healthcare Services

Having health insurance can provide access to a wide range of healthcare services, including preventive care, primary care, specialty care, and emergency services.

3. Peace of Mind

Knowing that you have health insurance coverage can provide peace of mind and reduce stress related to medical expenses and healthcare needs.

Conclusion

Health insurance is an essential component of financial planning in Florida, where healthcare costs are typically higher than the national average. By understanding the types of health insurance plans available, the requirements for coverage, and the benefits of having insurance, individuals and families can make informed decisions about their healthcare needs and financial well-being.