AARP Life Insurance: Everything You Need to Know

What is AARP Life Insurance?

AARP, also known as the American Association of Retired Persons, offers a variety of insurance products to its members, including life insurance. AARP life insurance is designed to provide financial protection for your loved ones in the event of your death.

Types of AARP Life Insurance

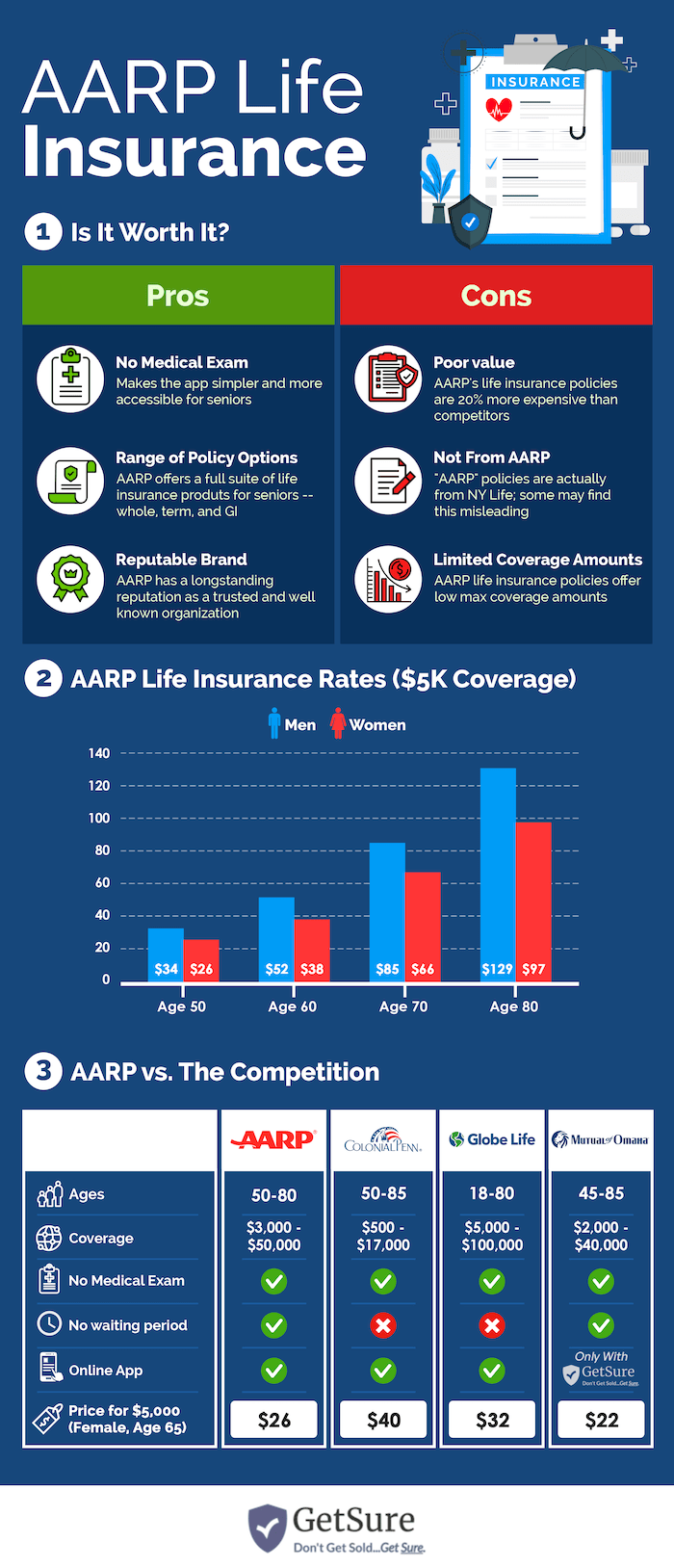

There are several types of life insurance offered by AARP, including term life insurance, whole life insurance, and universal life insurance. Term life insurance provides coverage for a specific period of time, while whole life insurance offers lifetime coverage. Universal life insurance is a flexible policy that allows you to adjust your premium payments and death benefit as needed.

Benefits of AARP Life Insurance

One of the main benefits of AARP life insurance is the peace of mind it provides knowing that your loved ones will be financially protected after your passing. Life insurance can help cover funeral expenses, outstanding debts, and provide income replacement for your family. AARP life insurance policies are also typically more affordable than policies offered by other insurance companies.

How to Apply for AARP Life Insurance

To apply for AARP life insurance, you must be a member of AARP, which is open to individuals age 50 and older. You can apply for life insurance online or over the phone. The application process typically involves answering a few health-related questions and may require a medical exam, depending on the policy you choose.

Conclusion

In conclusion, AARP life insurance is a valuable financial tool that can provide peace of mind and security for your loved ones. With a variety of policy options to choose from, AARP makes it easy to find a life insurance policy that fits your needs and budget. If you are a member of AARP and are considering purchasing life insurance, be sure to explore your options and find the policy that best meets your needs.