Insurance State Farm Health Insurance

What is State Farm Health Insurance?

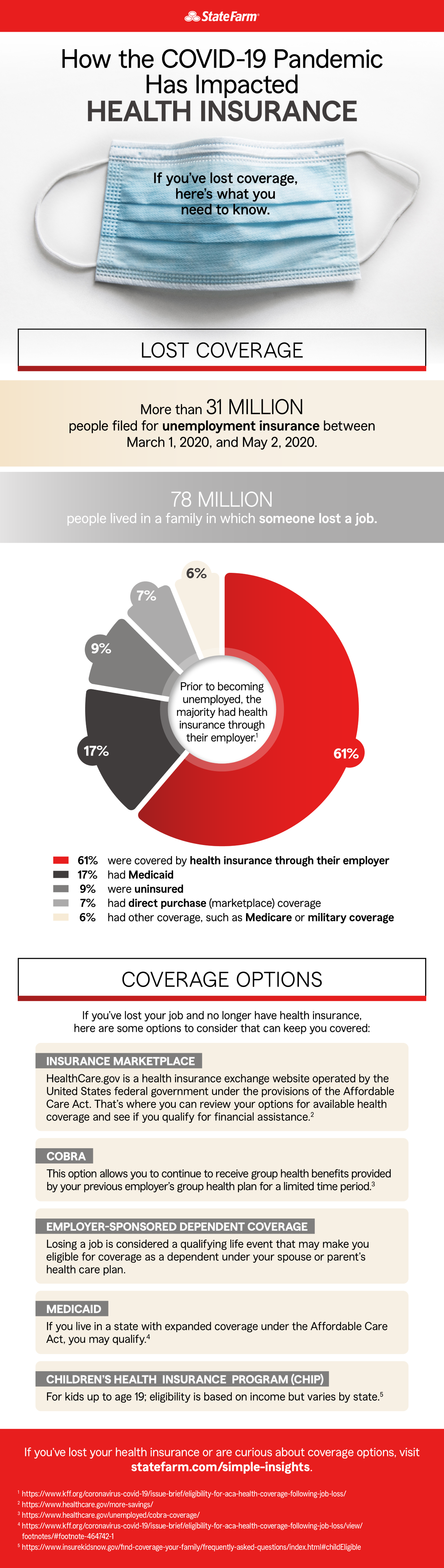

State Farm Health Insurance is a type of insurance coverage provided by State Farm, one of the largest insurance companies in the United States. It offers a range of health insurance plans to individuals and families, including medical, dental, and vision coverage. State Farm Health Insurance is designed to help policyholders pay for medical expenses and receive quality healthcare services when needed.

Benefits of State Farm Health Insurance

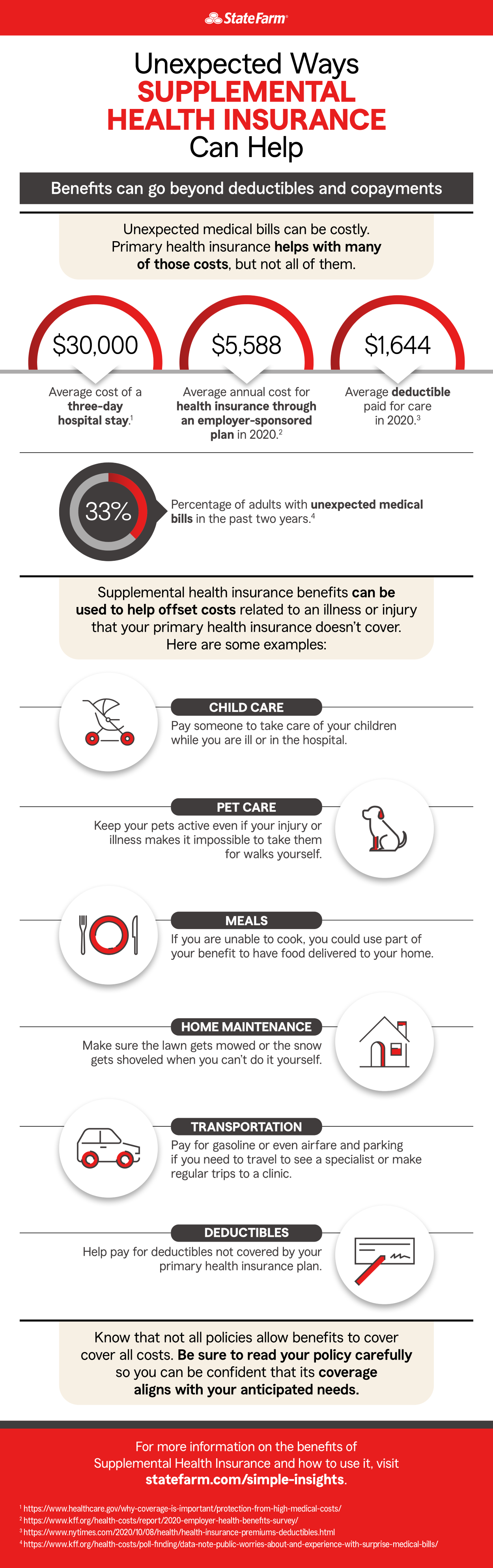

There are several benefits to having State Farm Health Insurance. One of the main advantages is that it provides financial protection in case of unexpected medical expenses. With the rising cost of healthcare in the United States, having health insurance can help prevent individuals and families from going into debt due to medical bills. State Farm Health Insurance also offers access to a network of healthcare providers, which can help policyholders receive timely and quality care.

Another benefit of State Farm Health Insurance is the peace of mind it provides. Knowing that you have health insurance coverage can alleviate stress and worry about potential medical emergencies. State Farm Health Insurance plans also often include preventive care services, such as annual check-ups and screenings, which can help policyholders maintain their health and catch any potential health issues early on.

Types of State Farm Health Insurance Plans

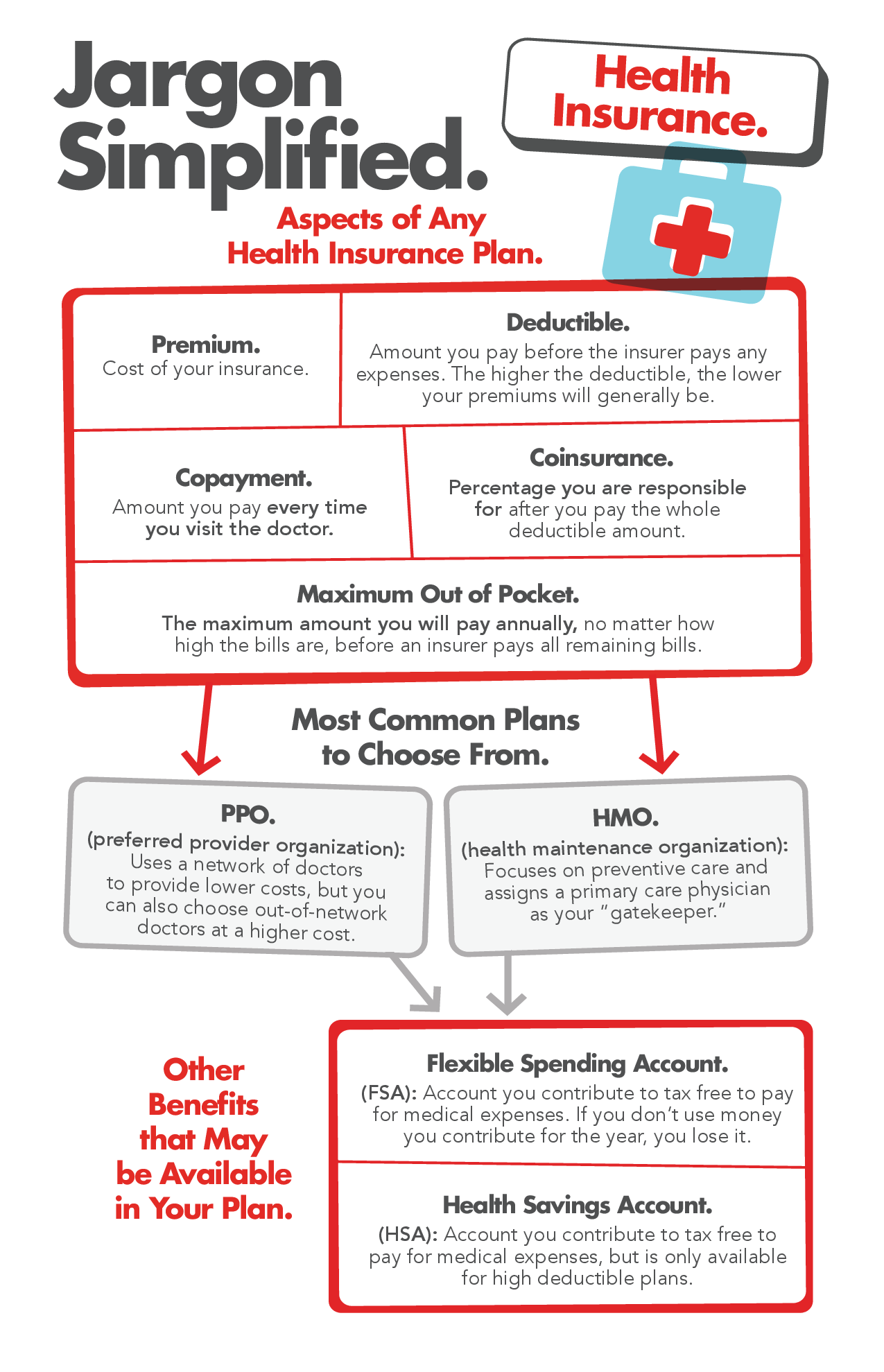

State Farm offers a variety of health insurance plans to suit different needs and budgets. Some of the most common types of health insurance plans offered by State Farm include:

Health Maintenance Organization (HMO) Plans: HMO plans require policyholders to choose a primary care physician and obtain referrals for specialist care. They often have lower out-of-pocket costs but may have more restrictions on healthcare providers.

Preferred Provider Organization (PPO) Plans: PPO plans allow policyholders to see any healthcare provider, but offer lower costs for services received from providers within the plan’s network.

High Deductible Health Plans (HDHPs): HDHPs have higher deductibles and lower premiums than other types of plans, making them a good option for individuals who are generally healthy and don’t anticipate needing frequent medical care.

Health Savings Account (HSA) Plans: HSA plans are paired with HDHPs and allow policyholders to save pre-tax dollars in a savings account to pay for qualified medical expenses.

How to Choose the Right State Farm Health Insurance Plan

When selecting a State Farm Health Insurance plan, it’s important to consider your individual healthcare needs and budget. Take into account factors such as your current health status, any chronic conditions you may have, and your expected healthcare expenses for the coming year. You should also consider the network of healthcare providers offered by each plan and any restrictions on coverage.

It’s a good idea to compare the cost and coverage of different State Farm Health Insurance plans before making a decision. Consider factors such as premiums, deductibles, copayments, and coinsurance to determine which plan offers the best value for your needs. Additionally, look for any additional benefits offered by each plan, such as coverage for prescription medications, mental health services, or maternity care.

Conclusion

State Farm Health Insurance is a valuable resource for individuals and families seeking financial protection and peace of mind when it comes to healthcare. With a variety of plan options to choose from, State Farm Health Insurance can help policyholders access quality healthcare services and receive timely medical care. By carefully considering your healthcare needs and budget, you can select the right State Farm Health Insurance plan to meet your individual requirements.