What is Term Life Insurance?

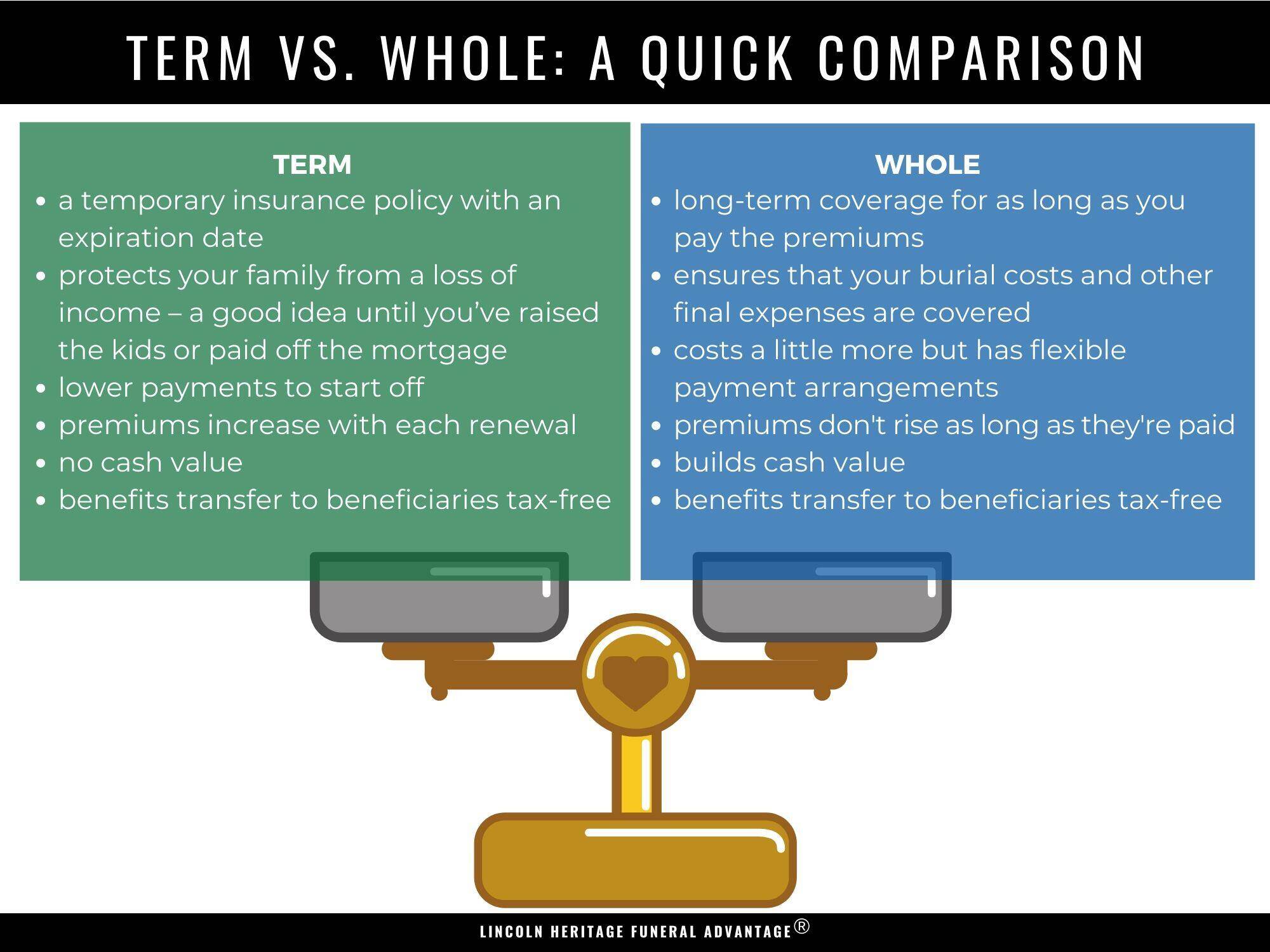

Term life insurance is a type of life insurance that provides coverage for a specified period of time, usually between 10 and 30 years. Unlike permanent life insurance policies, such as whole life or universal life insurance, term life insurance does not accumulate cash value over time.

How Does Term Life Insurance Work?

When you purchase a term life insurance policy, you agree to pay a monthly or annual premium in exchange for a death benefit that will be paid out to your beneficiaries if you pass away during the term of the policy. If you outlive the term of the policy, the coverage will expire and you will no longer be covered.

Why Should You Consider Term Life Insurance?

:max_bytes(150000):strip_icc()/Investopedia-terms-termlife-6451fde927474d4f8a81a5681efd393f.jpg)

Term life insurance is often a more affordable option than permanent life insurance policies, making it a popular choice for young families or individuals on a budget. It can provide financial protection for your loved ones in the event of your untimely death, helping to cover expenses such as mortgage payments, college tuition, or funeral costs.

Types of Term Life Insurance

Level Term

With a level term life insurance policy, the death benefit remains the same throughout the duration of the policy term. This type of policy is popular for those who want a consistent amount of coverage over time.

Decreasing Term

In a decreasing term life insurance policy, the death benefit decreases over time, typically in line with a decreasing mortgage or other financial obligation. This type of policy is often used to cover specific debts that will decrease over time.

Renewable Term

A renewable term life insurance policy allows you to renew your coverage at the end of the term without having to undergo a medical exam or provide evidence of insurability. This can be a valuable option for individuals who want to extend their coverage beyond the initial term.

Factors to Consider When Choosing Term Life Insurance

When choosing a term life insurance policy, it’s important to consider factors such as the length of the term, the amount of coverage needed, and the financial stability of the insurance company. You should also take into account your current financial situation, future financial goals, and the needs of your beneficiaries.

Conclusion

Term life insurance can be a valuable tool for protecting your loved ones and providing financial security in the event of your death. By understanding how term life insurance works, the different types available, and the factors to consider when choosing a policy, you can make an informed decision that meets your needs and budget.