Health Insurance: Understanding the Costs and Benefits

Health insurance is a crucial aspect of financial planning and healthcare management. It helps individuals and families cover the costs of medical expenses, ranging from routine check-ups to emergency treatments. However, the cost of health insurance can vary significantly depending on various factors, including age, location, coverage options, and pre-existing conditions.

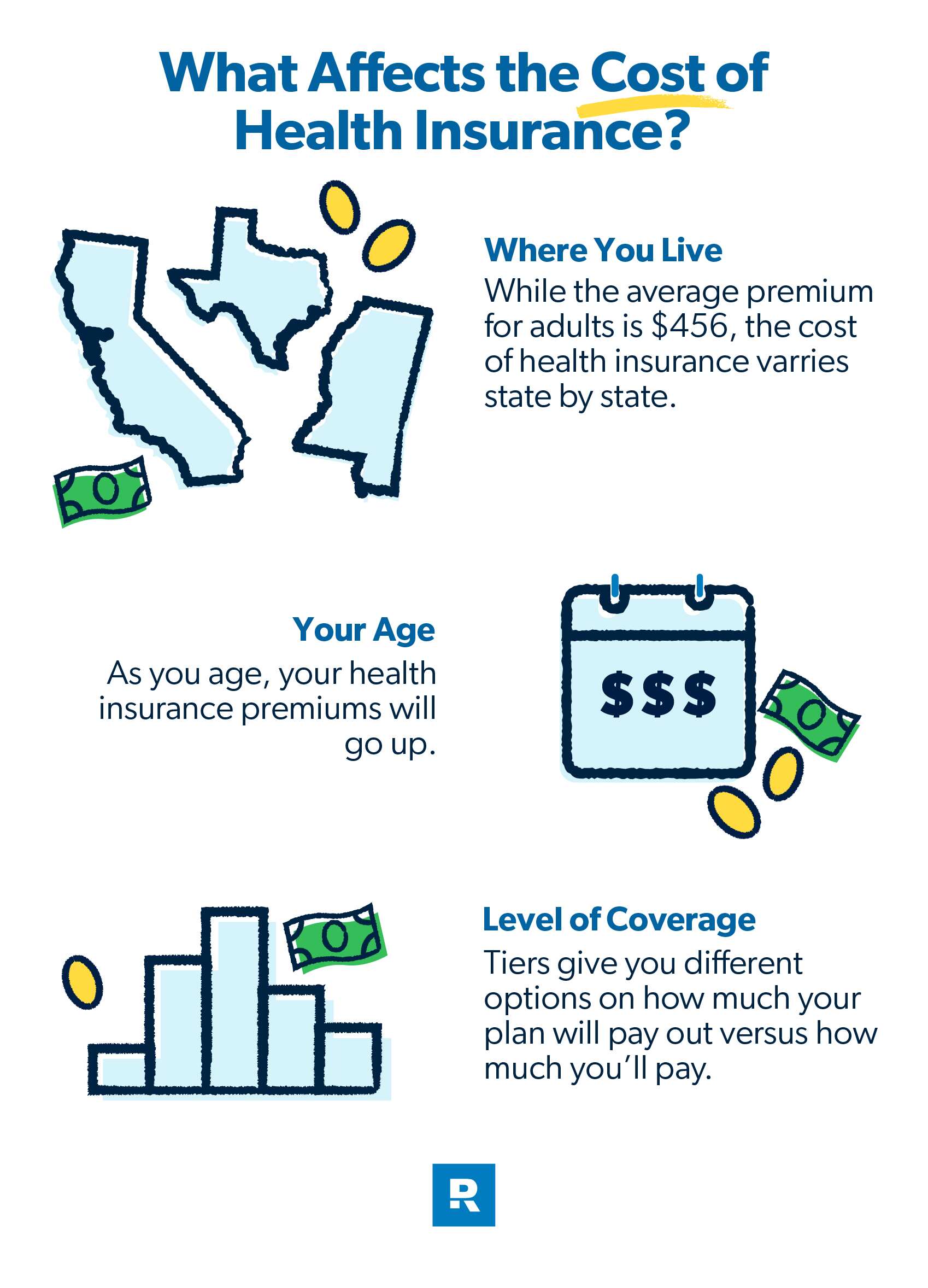

Factors Influencing Health Insurance Costs

When considering health insurance plans, it’s essential to understand the factors that can influence the cost of coverage. These factors include:

1. Age:

Age is one of the most significant factors that can impact health insurance costs. Generally, younger individuals pay lower premiums compared to older individuals. This is because younger people are considered less risky to insure and are less likely to have chronic health conditions that require expensive medical treatments.

2. Location:

The cost of health insurance can also vary based on your location. Insurance premiums are typically higher in areas with higher healthcare costs or limited healthcare providers. Urban areas tend to have more healthcare options, which can result in lower insurance costs compared to rural areas.

3. Coverage Options:

The level of coverage you choose will also impact the cost of health insurance. Plans with higher coverage levels, lower deductibles, and lower out-of-pocket costs generally have higher premiums. On the other hand, plans with lower coverage levels may have lower premiums but higher out-of-pocket costs for medical services.

4. Pre-Existing Conditions:

If you have pre-existing health conditions, you may face higher insurance costs or limited coverage options. Insurance companies may charge higher premiums or exclude coverage for certain conditions to mitigate the risk of costly medical treatments.

How Much Does Health Insurance Cost?

The cost of health insurance can vary widely depending on the factors mentioned above. On average, individuals in the United States can expect to pay between $500 to $1,500 per month for health insurance coverage. However, these costs can be significantly higher for families or individuals with specific healthcare needs.

Employer-sponsored health insurance plans can help reduce costs for individuals and families. Employers often cover a portion of the premium costs, making health insurance more affordable for employees. Additionally, government programs like Medicaid and Medicare provide low-cost or free health insurance options for eligible individuals.

Choosing the Right Health Insurance Plan

When selecting a health insurance plan, it’s essential to consider your healthcare needs, budget, and coverage options. Compare different plans based on their premiums, deductibles, co-pays, and coverage limits to find the best option for your situation. Additionally, consider factors like network coverage, prescription drug coverage, and out-of-pocket costs when choosing a health insurance plan.

Ultimately, health insurance is a critical investment in your health and financial well-being. By understanding the factors that influence insurance costs and choosing the right plan for your needs, you can protect yourself and your family from the high costs of medical care.